Online identification and digital signatures

We enable trust in a digital world.

Certified identification and signing solutions from fidentity that will delight both you and your customers. For better conversion rates. Maximum reliability and quick time-to-market.

Certified solutions.

Modularly combinable.

Whether IDENT, SIGN, or ONBOARD: Our solutions integrate seamlessly into your processes. Certifications guarantee compliance with all regulatory guidelines and reduce complexity.

Trusted by more than just the banks.

Companies from various industries rely on fidentity’s identification and signing solutions.

simpleSIGN.

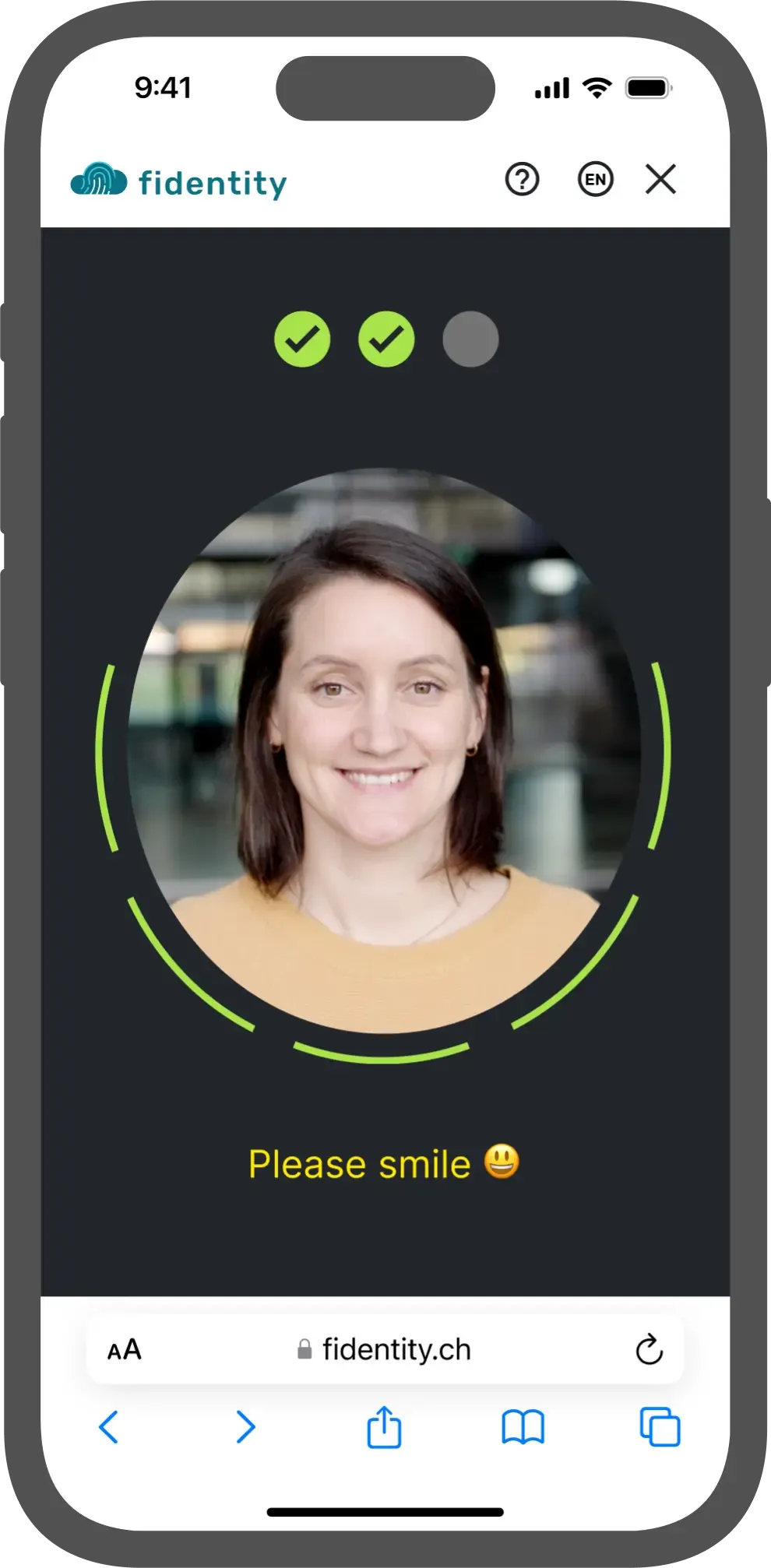

Like a wet ink signature. Done in 120 seconds.

A signature on paper is always legally valid but takes time. Digital signatures are fast, yet signing with a few clicks is legally uncertain. simpleSIGN is as secure as a handwritten signature and can be done in 120 seconds, identification included.

Legally valid digital signing: With a smartphone, a valid identification document, and a smile you can get a legally binding signature, which, in accordance with the Swiss Code of Obligations (CO), is equivalent to a handwritten signature.

News

The key to success.

Striking the right balance between compliance, security and customer convenience is often difficult. Compromises are often unavoidable.

Based on our experience, we have optimized our solutions the point where you no longer need to make any difficult compromises. You can meet the highest compliance requirements while offering a state-of-the-art user experience. And we continue to work to make our solutions better every day.

Simple

Identification and signing are completely seamless, requiring only a valid identification document, a smartphone, and a smile. The solutions are web-based. No app download. No SMS code. Convenient authentication via biometrically linked device login.

Secure

Security by design is our standard. In all our solutions, we integrate security aspects into the development process right from the start. Our bank-grade security framework naturally also complies with the data protection regulations according to GDPR (EU) and FADP (Switzerland).

Flexible

We use modular principle to quickly implement customised solutions that meet your specific requirements. Our applications are multi-channel capable and can be used seamlessly across various communication channels, such as web, app, mobile phone, chat, email without the need to make any adjustments.

Intuitive

Don’t keep your customers waiting and improve your conversion rates with our intuitive and user-friendly applications. Compared to conventional video identification solutions, it is possible to increase them by up to 50 percent.

Verified

We do not leave security to chance. This is why internal experts regularly check our applications for vulnerabilities using penetration tests. We also take part in a bug bounty program in which “friendly hackers” track down potential security vulnerabilities before it is too late.

Agile

We develop all fidentity components ourselves and do not engage in near- or offshoring. We also rely 100% on Swiss-made for operation and hosting. This gives us end-to-end control over our solution and allows us to easily extend it with individual modules.

Fast

60 seconds for successful identification. 2 minutes for a qualified signature. All decisions are made within seconds by our AI engine and are traceable, comparable, and repeatable. Of course, we can adapt decision criteria individually to your business use case.

Certified

Our solutions are audited by KPMG: SIGN meets the highest legal signature standard, comparable to a handwritten signature. KPMG also confirms compliance with the requirements ofFINMA Circular 2016/7, FINMA Circular 2018/3 (Outsourcing) and 2008/21 (Operational risks).

Integrated

All our solutions fit seamlessly into your business processes and put your brand at the forefront. Thanks to our sophisticated white labelling system, you can adapt colours, fonts, and logos to your individual requirements, allowing you to create a consistent brand experience

Certified at the highest level.

fidentity stands for the highest security and compliance standards. We are certified in accordance with ETSI TS 119 461 , the leading standard for secure proof of identity, on which both the Swiss Digital Signature Act ZertES and the European eIDAS Regulation are based. Our certification also covers standards such as DIN EN 419241-1, ETSI EN 319 401 and ISO/IEC 30107-3.

We provide innovative and legally compliant solutions that adhere to the rigorous Swiss and European signature laws (ZertES and eIDAS) as well as anti-money laundering regulations, such as the FINMA Circular 2016/7. Our bespoke solutions combine security and innovation, making them ideal for the Swiss and European legal framework.

You can find our current certificates under ZertES and eIDAS here.

In addition, fidentity operates an Information Security Management System (ISMS) that is certified in accordance with ISO/IEC 27001. This certification confirms a systematic and verifiable approach to identifying, assessing, and managing information security risks across defined processes and systems. View the ISO/IEC 27001 certificate here.

fidentity keeps you securely compliant at all times - everything is provided from a single source and certified to the highest standards.

Contact form

Send us a message here, and we'll get back to you straight away. Or, feel free to give us a call.

Please note: For any questions or issues related to the identification or signing process, please contact the technical support of the respective provider directly. Inquiries of this nature cannot be processed through this contact form.

Uncomplicated. Virtual.

Arrange an online exchange with the sales team now.

Head of Sales and Business Development

Book nowOur partnerships for your success.

We rely on strong partnerships for an outstanding product that is perfectly tailored to your needs. Our extensive network ranges from local to national and international partners.